CREDIT INSURANCE FOR SAFE TRADING

Are you looking to…

- Grow your business

- Gain insight into your customer base

- Collect your debts more quickly and easily

With Credit Insurance you can target markets and sectors which are safe and stable to trade in and use information to focus your efforts on financially healthy customers.

Why Credit Insure?

Benefits of Credit Insurance:

- Risk Prevention

- Protecting your Cash Flow

- Business Development

- Secured Trade Finance

- Supplier Relationship

- Enhanced Credit Management

- Peace of Mind

Companies grant payment terms to their customers every day - it’s a routine way of doing business. Amid the excitement of offering payment terms to new customers companies don’t always think of the risk they are taking – what happens when a customer defaults or a business closes down?

Late payments take their toll…in fact unpaid invoices can represent as much as 35% of a company’s assets.

Credit Insurance protects businesses from bad debt caused by a customer’s insolvency or payment default. It safeguards cash flow.

“ We self-funded the company but we knew its net worth could be depleted quickly if we were hit with a bad debt and we concluded that credit insurance was the best way to protect our cash flow” – Faretrade Ltd, Coface Client

COFACE - Trade with Confidence

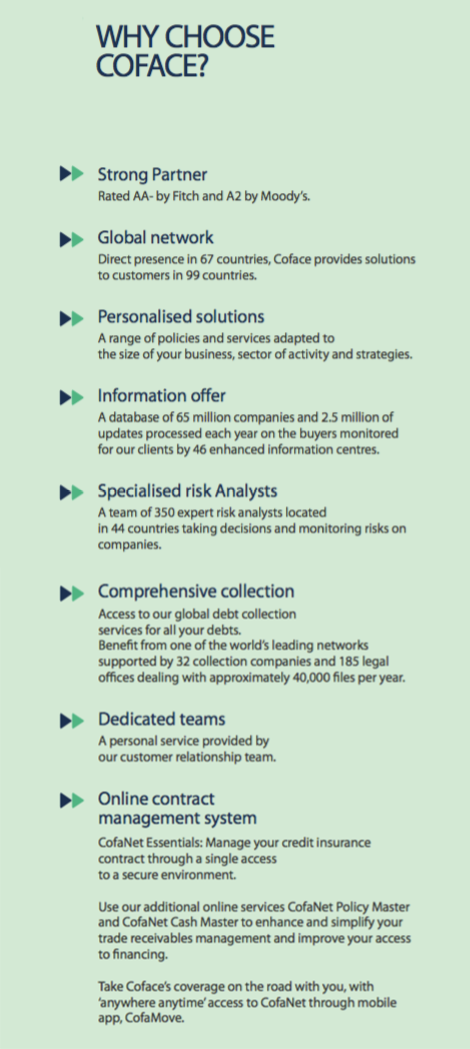

Our Credit Insurance Partner has been supporting the development of international trade for over 60 years and offers Export Trade Credit Insurance in over 200 countries.

This international network combined with business information on over 65 million companies means that you can be confident that wherever in the world you are trading we will know the opportunities and challenges you face.

WHAT IS CREDIT INSURANCE?

It is an effective financial risk management tool that safeguards your company against losses sustained arising from non-payment of trade related debts.

Credit Insurance ensures that your company is not adversely affected by the unforeseen failure of one or more of your customers; it is also a tool to help you manage your risks.

WHAT ARE THE MAJOR BENEFITS?

- Prevention of bad debts.

- Protect your cash flow and your balance sheet

- Deliver on your anticipated income

- Enhance your credit management processes.

- Save on bank financial guarantees or Letters of Credit.

- Access to better borrowing terms.

- Peace of mind

How does it work?

TRADE CREDIT INSURANCE

Credit Insurance protects businesses from bad debt caused by a customer's insolvency or payment default. It safeguards cash flow. So should the worst happen and non-payment occurs credit insurance will replace the cash, safeguarding the future of the company.

BUSINESS INFORMATION

With Coface as a partner you can extend credit to your overseas customers confidently by gaining access to Coface's powerful and dynamic business database - providing valuable credit ratings and business information on over 65 million companies worldwide.

DEBT COLLECTION

Coface's debt collection services help you to manage your receivables more efficiently. Our international network provides global coverage and debt collection through our direct presence and partnerships in 97 countries.

Case Study 1

How Coface helped a globally recognised manufacturer pursue promising opportunities for export growth In an increasingly competitive sector a leading manufacturer needed to maximise existing sales and expand into new markets without increasing their exposure to bad debt. With 340 underwriters around the world and an unrivalled presence in 100 countries they were able to trade with con dence knowing that Coface’s information is informed by local expertise.

“It’s comforting to work with a company that has up-to-date information and can give us a professional view of the risk. We take their credit ratings and opinions very seriously”

For all other information in relation to Credit Insurance, please get in touch & our in-house QFA Team:

or call us on 01 6279495

Our walk in office provides access to qualified financial advisors covering finance in Celbridge, Lucan, Maynooth, Leixlip, Clane, Naas and Kildare.